Balmer Lawrie Investments ltd has lot to catch up.

Balmer Lawrie Ltd has Market capitalisation of 1640 crores as closing date 20- Jul-2014 with CMP of 578 with Face value of 10.

Balmer lawrie Investment Ltd has Market Capitalisation of 557 crore as on closing date of 20- Jul 2104 with CMP of 250 with Face value of 10.

Balmer lawrie Investment Ltd has Market Capitalisation of 557 crore as on closing date of 20- Jul 2104 with CMP of 250 with Face value of 10.

Balmer Lawrie Investment ltd like any holding company trades at discount but offlate the discount is quite steep and represents opportunity to be considered in one's long term portfolio.

I see this as Corporate Bond which not only increases the Book value every year but also increases the Dividend payout since last 5 years.

It has soon great consistency in last 5 years & it's major verticals are directly pegged to Country's GDP.

Balmer Lawrie Investment Ratios for last 9 years.

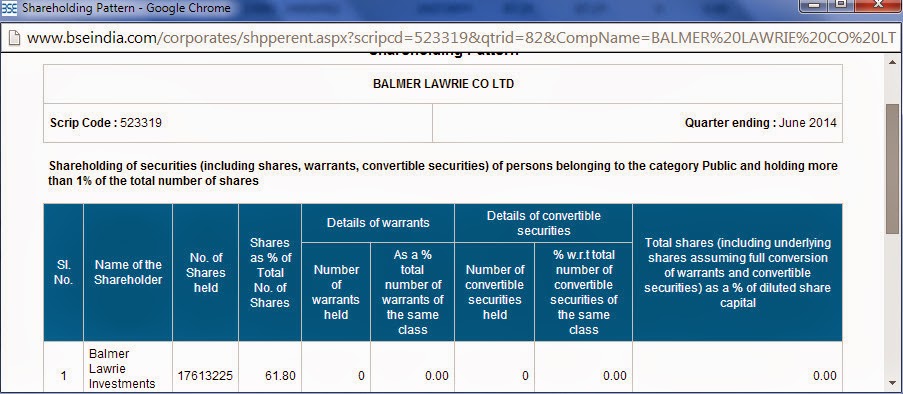

Balmer Lawrie Investments Ltd has been solely formed with the intention of divesting its holdings in Balmer Lawrie Company Ltd.

Although i'm interested in writing about Balmer Lawrie Investment we need to first understand bit of Balmer Lawrie Company ltd's History which is as follows.

Company was started by 2 Scotsmen Stephen George

Balmer & Alexander lawrie as Tea trading, Tea Blending, Shipping &

Forwarding business

In Year 1937, it had setup it's first grease plant at Kolkatta.

In 1969, Balmer Lawrie lost the managing

rights over 40 Tea gardens as the Managing Agency was abolished.

In 1972, Management divested their stake to

Indo-Burma Petroleum Company.

Due to Nationalisation of Oil Companies in

India, Company which was subsidary of IBP was transferred to Indian Oil in

2002. Balmer Lawrie Stake was transferred to Balmer Lawrie Investment Ltd .

Balmer Lawrie Investments Ltd has been

solely formed with the intention of divesting its holdings in BLCL.

CSR activities under taken by Balmer Lawrie.

Balmer Lawrie (UK) Ltd. 100%

Balmer Lawrie (UAE) Llc. 49%

Balmer Lawrie - Van Leer Ltd. 48%

Transafe Services Ltd. 50%

Avi Oil India Private Ltd. 25%

Balmer Lawrie Hind Terminal Pvt. Ltd. 50%

Balmer

Lawrie – Transafe Services ltd history:

In FY10, BLVL had acquired a 50% stake in

Transafe Services Limited (TSL) for a consideration of Rs.

18.18 crore. With TSL filing for CDR, this

investment is likely to be written off."

Balmer

Lawrie - Van Leer limited history:

BLVL is a joint venture between Balmer

Lawrie & Company Limited and Greif Inc, manufacturing steel drum closures

and plastic drum/containers. The company was incorporated on 12th February 1960

and was originally known as Indian Flange & Manufacturing Company Pvt. Ltd.

In 1993 the name was changed to Balmer

Lawrie - Van Leer Limited (BNVL), Balmer Lawrie and Royal Packaging Industries

Van Leer NV emerged as major shareholders.

The company went in for a public issue on

26th April 1994.

In 2007, the company decided to de-list

from the stock exchange and the shares were bought back by the parent company

Greif International Holding (previously

Royal Packaging Industries Van Leer NV).

Key

Points of Balmer Lawrie Travel:

In Feb 2014- Balmer lawrie acquired

vacation exocita for 20 crores.

Vacation exotica has started it's operation

in 2007 & had staff strength of 110 members at time of acquisition.

Vacation exotica gives Balmer Lawrie access to

41 000 - Indian client base & tap network of 100 plus preferred overseas

partners. This acquisition complements the nationwide Tour & travel offices

setup b Balmer & withstand the competition from Online portals.

Vacations Exotica average sales growth of

25 per cent for 3years and its tours and travel business has revenues of around

Rs 120 crore in year 2013.

Vacation Exoctic earns 40% of it's revenue

from Ticketing which can be a very good compliment to Balmer Lawrie's existing

infrastructure on Tours & Travels.

Vacation Exoctica has rating of 3.7 in

Justdial & Glassdoor3.

Indian Govt employees roughly 19 million

people (3.4 Central Govt, 7.2 State Govt, 6.4 Quasi Govt 9 (Reference: https://kgovindan.wordpress.com/2009/08/)

Online Portal

http://balmerlawrietravel.com.

Online Portal

http://www.vacationsexotica.com.

Tours and Travel segment of Business breakup:

Balmer Lawrie has done sales of 1161 cr (after

exclusion of Inter segment revenue) in FY 2014 & PBT of 24cr for FY14.

Balmer Lawrie has done sales of 1120 cr (after

exclusion of Inter segment revenue) in FY 2014 & PBT of 32cr for FY13.

YoY Sales growth rate has been 4% . Capex

is 122 crores in FY14, generating ROCE of 14% for the company.

Key

Points of Balmer Lawrie Lubricants

Balmer Lawrie sells grease under the Brand

name Balmerol.

It has 3% of the Market share &

underwent some re-branding exercise in the year 2012.

It has 4 blending plants in Kolkatta,

Chennai , Mumbai (Sewri) & Silvassa.

Govt of India can consolidate all lubricant business under one roof and compete with MNC's such as Shell & Castrol.

Servo is brand from HPCL, Tide Water Oil ltd sells under Bran Vedol is another company from PSU sector competing with each other.

Balmer Lawrie sells grease mainly to

Industrial sectors such as Steel, Mining , Railway , Automobile & Defence

which accounts for 70% of it's Lubricant Sales.

Company added 20000 tpa in it's Silvassa

plant in Year 2013 at cost of 35crores.

Company's Sewri (Mumbai) plant of 6000 tpa will be shut down due to

Environmental issues.

G&L operates mainly in two wings -

Automotive grades, which constitute about 60% of the market and Industrial

& Marine Grades, which represent the balance

Balmer Lawrie has only captured 2% of

market share in Lubricant & 24% in Grease segment.

Balmer lawrie lacks the marketing skills and Distributor network has to be improvised.

Reference:

http://www.slideshare.net/saturnchallenger/balmer-lawrie-lubricants-and-greases-distributorship-review?qid=9ea89b4a-8a23-4497-aed2-8a00dbdab840&v=default&b=&from_search=2

The Lubricant industry in India has been

pegged around Rs. 15,000 crore annually with consumption estimated at around

1.50 million tonnes in 2012-13. (Balmer's Lawrie's management Insights for

2012-2013)

Financials of Balmer Lawrie Ltd by Segment for year 2013 & 2014

Net profit TO Market Cap: 9.53%

TAX %: 26.85%

Operating Cash flow for Year 2013: Rs 70.59

DEBT PER SHARE: Rs 79.82

Net Current Asset PER SHARE: Rs 259.63

Net Block PER SHARE: Rs 201.57

Working Captial PER SHARE: Rs 259.63

SALES PERSHARE: 1347.45

CONTINGENT LIABILITY PERSHARE: 92.11

CMPTODEBTPERSHARE: 7.25

CMPTOCONTILIABPERSHARE: 6.28

CMPTONETBLOCKPERSHARE: 2.87

CMPTONCAPERSHARE: 2.23

CMPTOWCAPPERSHARE: 2.23

Working Capital Days: 20.52

Net profit: 166.07Cr.

EVEBITDA: 4.89

Altman Z Score: 4 plus

5 Year Growth rate in Business is what I observe for Industrial companies.

Key

Risk for Investments in Balmer Lawrie Investment:

Upward revision in Dividend Distribution

Tax.

Any Reduction in dividend payments by the

subsidiary will impact the Price of the Company.

Dividends paid by a domestic company are subject to the dividend distribution tax (DDT) at an effective rate of 16.995%.

Comparision of Valution for peers in the Industry

.

Conclusion:

I don't want to leave a Target Price or BUY recommendation.

One has to read and decide what he intends to do with this beautiful company.

but holding companies always come with discounts atleast by 30-40%

ReplyDeleteHolding company by Govt promoter is lucrative as this holding company was formed formed for disinvestment. Also I have considered 20% Discount before arriving at fair value.

ReplyDeleteMust compliment you - very exhaustive 360 degree analysis. I have been tracking and studying this co for last 2 years. I am a non-finance guy, hence shifted from BL to BLI. I have learnt from your analysis that holding co carries a discount of 20 to 30%. Even if we take it 30%, it still has to catch up. My sense says 1) it is a safe bet 2) regular dividend with inflation embedded in it 3) 15 to 20% upside in 2014-15 FY in the remaining quarters.

ReplyDeleteThanks

Rajendra Bisht

Can you please update the report as many things changed...BL came out with bonus issue....now quoting post bonus at 135...BLI is at 475...gone past BL...

ReplyDeleteWe are a Professional Turnkey Project Management company. We supply plants and machinery for Lube Oil Blending Plant, Grease Manufacturing Plant, and various other Petrochemical Industries. On the other hand, , we have got expertise in different plants such as Cooking Gas Cylinder mfg. Blow Moulding plant, etc. We have supplied plants and Machinery around the globe such as Africa, Asia, the Caribbean, Central America, Europe, North America, etc Grease Blending Plant

ReplyDeleteNice articles and your information valuable and good articles thank for the sharing information GREASE MANUFACTURING PLANT

ReplyDeleteRespect and that i have a neat provide: How To Properly Renovate A House home renovation services near me

ReplyDeleteWe are a Professional Grease Manufacturing Plant Management company. We supply plants and machinery for Lube Oil Blending Plant, Grease Manufacturing Plant, and various other Petrochemical Industries.

ReplyDelete