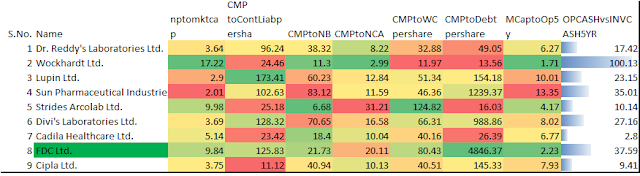

Future Group Arbitrage Investment Matrix

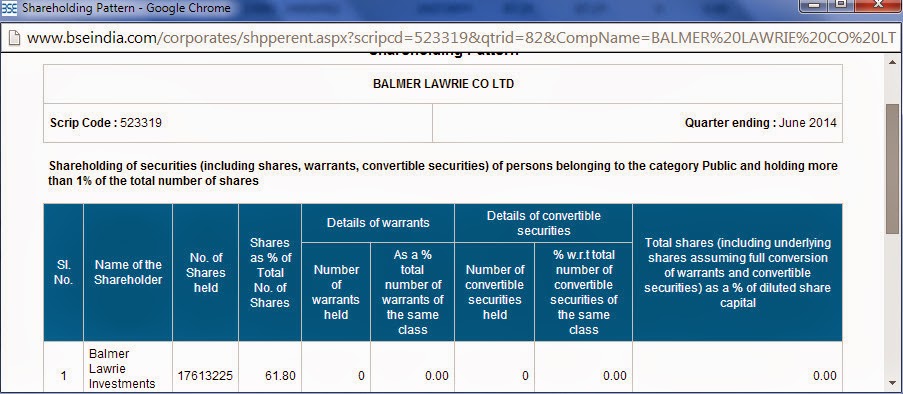

Future Group Companies going restructuring before getting bought over by Reliance Retail. Existing companies are merging with Future Enterprise Limited. This presents excellent opportunity to but some of Group companies and this matrix will help you decide which is best bet. Ex Record date will take around 3months based on past experience. Risk Elements: Poor Performance of FEL Limited Post Deal. Poor Conversion Ratio from FEL to Reliance Retail in Future.