Dena Bank

Dena Bank CMP:57 Current P/E 3.45 TGT PRICE:75 ON CONSERVATIVE P/E OF 5.

Dena Bank was founded on 26th May, 1938 by the family of Devkaran Nanjee under the name Devkaran Nanjee Banking Company Ltd.

It became a Public Ltd. Company in December 1939 and later the name was changed to Dena Bank Ltd.

In July 1969 Dena Bank Ltd. along with 13 other major banks was nationalized and is now a Public Sector Bank constituted under the Banking Companies (Acquisition & Transfer of Undertakings) Act, 1970. Under the provisions of the Banking Regulations Act 1949, in addition to the business of banking, the Bank can undertake other business as specified in Section 6 of the Banking Regulations Act, 1949.

Capital Adequacy Ratio: 10.73. Industry Avg 13.

Return on Equity Mar'09: 24%.

Sales Gwth Mar'09: 29%

EPS Mar'09: 14.74

Yield on Fund Advances : 8.8%

Net Profit Margin: 10.95%

Contingent liabilities to Total Assets Mar'09: 30%

Qtr Results

EPS Gwth: Jun'09= 68%.

EPS: 4.01

Net Profit 115

Sales Gwth: 26%

Capital Adequacy Ratio(Jun'09) 12.39%

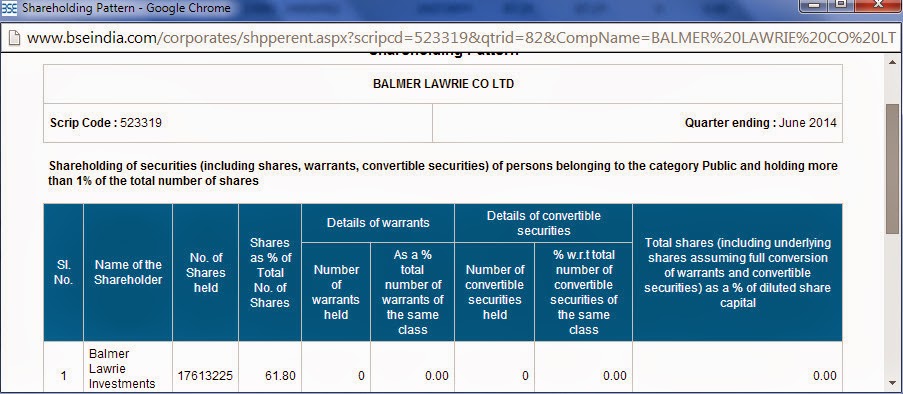

Government Share holding% 51.19

Conservative P/E of 5 is due to slow implementation in Banking Infrastructure (Automating the current systems) & regular strikes by Banking Employees.

Neverthless one can consider investing in Dena Bank & Vijaya Bank for medium term. Both this banks have shown uptrend in past 2 trading sessions.

Dena Bank was founded on 26th May, 1938 by the family of Devkaran Nanjee under the name Devkaran Nanjee Banking Company Ltd.

It became a Public Ltd. Company in December 1939 and later the name was changed to Dena Bank Ltd.

In July 1969 Dena Bank Ltd. along with 13 other major banks was nationalized and is now a Public Sector Bank constituted under the Banking Companies (Acquisition & Transfer of Undertakings) Act, 1970. Under the provisions of the Banking Regulations Act 1949, in addition to the business of banking, the Bank can undertake other business as specified in Section 6 of the Banking Regulations Act, 1949.

Capital Adequacy Ratio: 10.73. Industry Avg 13.

Return on Equity Mar'09: 24%.

Sales Gwth Mar'09: 29%

EPS Mar'09: 14.74

Yield on Fund Advances : 8.8%

Net Profit Margin: 10.95%

Contingent liabilities to Total Assets Mar'09: 30%

Qtr Results

EPS Gwth: Jun'09= 68%.

EPS: 4.01

Net Profit 115

Sales Gwth: 26%

Capital Adequacy Ratio(Jun'09) 12.39%

Government Share holding% 51.19

Conservative P/E of 5 is due to slow implementation in Banking Infrastructure (Automating the current systems) & regular strikes by Banking Employees.

Neverthless one can consider investing in Dena Bank & Vijaya Bank for medium term. Both this banks have shown uptrend in past 2 trading sessions.

What will be the possible target for dena bank in next two week. I buy this script today at 62.30

ReplyDeletepls suggest me some other stock for short term as well..

thanks!!!

Pls reply to my post sir!!!!

ReplyDeleteHi Pappu firtly I'm imperfect in perdicting short term as there is no media/ big punter behind me. Secondly I believe Dena Bank will achieve it's tgt by end of Nov-Dec as i see huge buying interest will no media communications. U shall see media communication towards end. I always do cash based trading with few scripts in portfolio .once target achieve i look for others. I have added & will add bit more once i recieve my salary. Due to futures expiry u can expect eveyone taking negative & tht's good buying opportunity.

ReplyDeleteHello Sir...

ReplyDeleteShould i exit From Dena Bank Now as it touches the target price of 75 (as mention by you) or should i continue to hold it..?

Please reply as soon as possible.

Thanks

If u are daily market tracker hold on to it for tgt 80, If medium term investor exit in part & leave profits to continue.

ReplyDelete